Abstract

Artistic practice has the potential to immerse in modes of research, exchange, compilation, and presentation. It weaves a multiplicity of approaches and investigations into a fabric made of concepts, notions, objects, materials – and the relations between them. It opens new pathways into artistic expression beyond marketable branding strategies and the enclosures of capital, but also undermines the established notion of the autonomy of art and its own logics of production. This foregrounds the question of aesthetics that can deliver means for perceiving and appreciating forms of engagement and agency by bringing together theory, science, and art in new ways. This text proposes an approach in which autonomy is reconceptualised as a dynamic, open, sometimes aleatoric and instantaneous process (acts connected to a multitude of contingent moments). It purposely integrates ambiguous heteronomous influences in order to make resolution in the full meaning of the term.

On financial technowledge

Thinking in pictures … stands nearer to unconscious processes than does thinking in words, and is unquestionably older than the latter both ontogenetically and phylogenetically.

(Freud 1927)

For me, working as an artist entails encountering a crack, a flaw, an opening. I use the word encounter deliberately, as it implies a kind of serendipity, a chance encounter, an experience of inconsistency enigmatic enough to become magnetic. I insert myself into the gravitational field with the twofold tactics of research and imagination in order to find, i.e. construct, a trace that leads to a strategy. The strategic focus could be a term, a notion, a process or an image but it allows me to expand on it and connect it to other topics or fields seemingly unrelated at first.

One example for this approach is what I term the figure of the “renegade”. The topos – and it is a place, a location, a spatial knot as much as it is a subject and a technology – derives from a research project I did on forensics and its relation to financial markets. The project started with the invitation to participate in the show FORENSIS curated by Eyal Weizman and Anselm Franke at Haus der Kulturen der Welt in Berlin in 2014. I had already done work on algorithmic trading and the so-called “Flash Crash,” a market crash that occurred on May 6, 2010 1. And I thought that this topic would be a promising example, as the case as well as the subsequent investigations showed a rather ambivalent quality even though they were extremely data driven. On the one hand, there was an epistemic edge, which seemed corrupted from the beginning. On the other hand, I wanted to investigate how finance has achieved such a powerful position without utilising the more usual forms of representation we think of when it comes to power regimes.

So I looked into the material I had collected on the Flash Crash and started researching it more thoroughly. I also convinced the financial data analyst Nanex to cooperate. Nanex is known for its seminal role in creating a counter-narrative to the official statement resulting from the investigation undertaken by both the Securities Exchange Commission (SEC) and the Commodity Futures Trading Commission (CTFC). The official report attributed human error for causing the Flash Crash while Nanex, amongst others, followed a different route by exploring technological sources and concluded that algorithmic operations caused the crash.

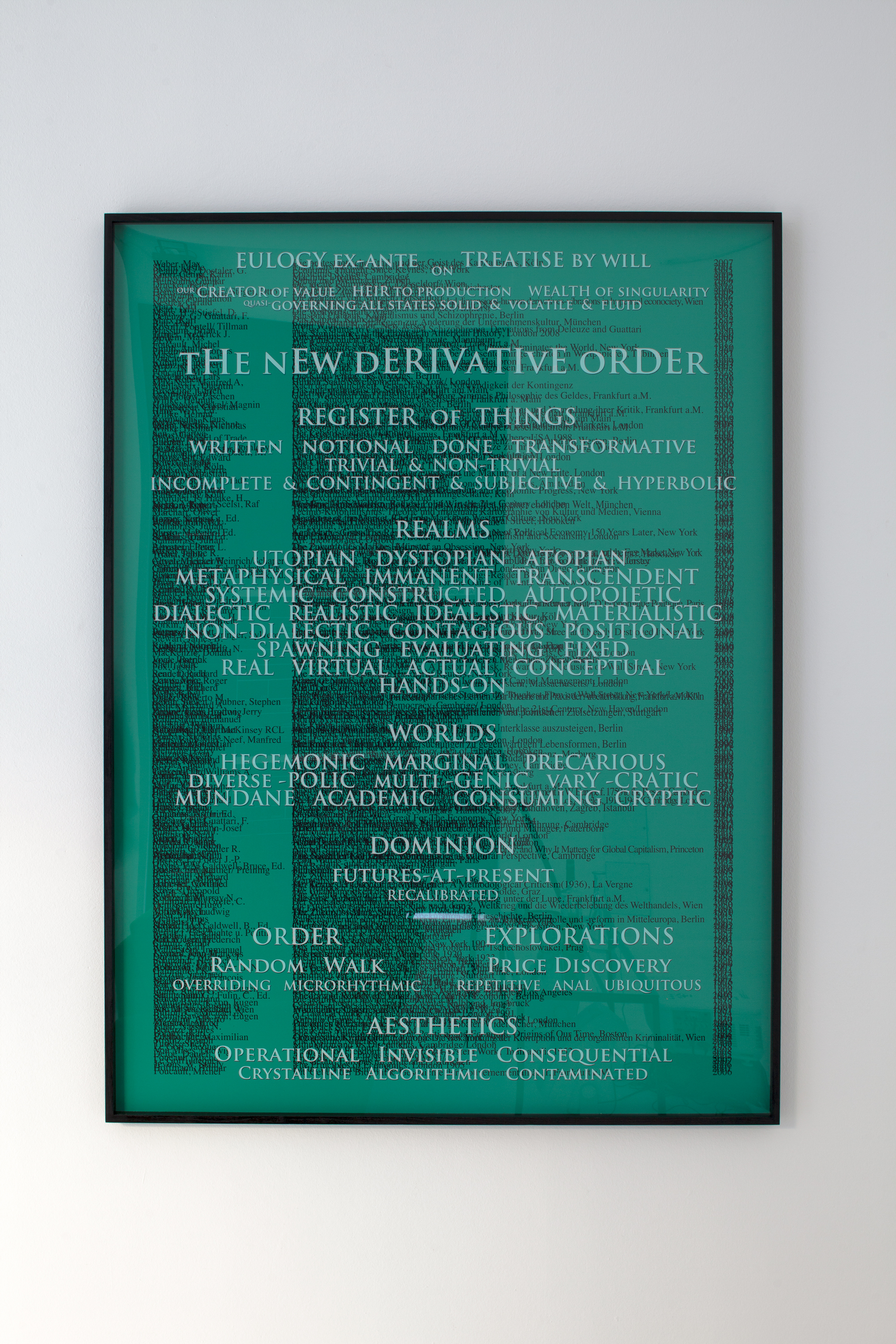

When I scrutinised the material, the reports, and the visualisations, something surfaced; a discrepancy, that to Nanex, was a scandal concerning the official investigation. But to me the material gave reason to expect wider implications, due to the fact that this discrepancy not only annihilated the core of forensics, but also of the epistemic as such, and thus constituted a specific corruption of knowledge-production and decision-making. In order to throw light on this scandal, I propose the term “resolution”. The multifaceted semantic field of the term and its technological as well as social significance – ranging from visualisation, discrimination, and intelligence to intention, purpose, (common) initiative and (joint) decision-making – seems to offer a collectivity. It presents a conceptual basis for an artistic practice that does not lose sight of rethinking socio-political constitutions as well as the conditions that make the ruptures and breaches of social contracts possible in the name of proprietary and other interests. It could thus play a crucial role in the effort to trace aesthetic as well as political consequences. In other words to move from the aesthetics to a poietics (making) of dissent within an artistic paradigm that is interested in the consequences of events, assemblies, processes and decisions beyond mere relational aspects.

Such an approach does not hinge on an artist/observer relation that has been a key aspect of contemporary art for decades. Rather, it fosters collaborative affinities of different kinds of experts and expert systems – artists and scientists, processes and technologies – and the public come together in common attempts to reconceptualise and re-orient the aesthetics of knowledge-production by inserting themselves into their making. This approach revitalises the initially liberating program of the avant-garde by affirming the demise of the political thrust of “making everybody an artist,” which has become the creative core of the neoliberal project since at least the late 1990s. It also affirms the fundamental premise of technologies that process dissemination, visualisation and decision-making as well as its various incorporations of enclosures (e.g. black boxes), which underlie Information Capitalism. It does so because without acknowledging their real power and impact we cannot move on from an anaesthetic arbitrariness of form towards a conversation of activist hacker-theory-experts – a realm addressing a growing population of digital natives – on consequential content. Such a transdisciplinary approach (or post-disciplinary, to use a more fashionable term) is essential if we want to move from an aesthetics to a poietics of resolution, i.e. from a quasi-unconscious state of consumption to an involved engagement that not only develops counter-tactics against proprietary interests but realises political agency within metastable information flows. In the following, I will briefly address an example, which on the one hand highlights the complexities and intricacies of such an endeavour as well as its achievements and failures. On the other hand, it outlines an instance of artistic practice in the realm of an aesthetics of resolution 2.

Aesthetics of resolution

In finance, the derivative pricing of contingent expectations serves as a resolution regime to move along (in parallel with) the uncertainty of the future. Hence, mathematical recalibration computed to render prices for any conceivable outcome, i.e. risk potential, “creates” the future at any present moment of trading. The present as we know it has no bearing here; the moment it emerges (every moment), it arrives as price and instantly turns into historic data, entering a new cycle of calculating profit probabilities. The past succumbs to a probabilistic reservoir for the quantification of future events, while the present vaporises in the actualisation of the one price realised from the myriads of virtual prices that “inhabit” these volatile “galaxies” of risk options. These quickly fading “bodies” increasingly include a commodity called human capital. Thus, in what I term the derivative condition of social relations 3, not only those contingent futures that emerge from subjectivities and their relations “collapse”; it is the present in which subjectivity and agency are born in the first place which decays in microseconds.

While the derivative markets’ mode of production generates risk options that quasi-materialise every conceivable future at present, algorithmic trading (as it originated in the mid-1990s) commenced with an emphasis on automated trading routines and arbitrage opportunities — more or less risk-free profits gained from instant price differences between markets and exchanges. Here, depending on strategy, volume and speed matter 4. As in derivative markets, profound specialist knowledge and intellectual property are the condition sine qua non for capitalising on these strategies. This has attracted a large number of so-called “quants” (engineers, mathematicians, physicians) who have subsequently substituted open-outcry markets and human market makers (usually of low-income backgrounds) with electronic trading and bots. Hand in hand with the emergence of a new financial elite we witness an increase in electronic resolution methodologies both technically as well as socially. In its wake, the paradigm of resolution shifted from colonising macro-space to exploiting micro-time; a move that under the auspices of free-market ideology has had a tremendous impact beyond markets on the way we experience agency, security and decision-making in society 5. Space travel through the vastness of cosmic space remains popular fiction in which we are unconscious – in a state of induced low resolution of sense perception. What has become reality, however, is a presence in which we are “unconscious” in the sense that (without resolution-enhancing devices) we are incapable of experiencing a present that evaporates in moments where future and past collide. This is not to say that technological progress is intrinsically corrupt. Nevertheless, self-governing proprietary interests are prone to blur our shared vision of realities that affect us profoundly. As a consequence of such “an-esthetics,” there is urgency to invigorate the notion of resolution across all the term’s semantic registers.

The term “resolution” might at first be evocative of a means to an end in the service of visualisation, a detail in the chain of technological operations. At the same time, however, it is a tool that combines technology with supervision and exclusion, but also agency. Focusing on resolution is not simply a question of technical specifications or layers of visualisation. Rather, resolution techniques embody powerful and ambivalent contraptions of technowledge 6, a term I use to describe the fusion of technology and knowledge in the age of algorithmic automation. Resolution serves the construction of enclosures typical for the differentiation machine of information capitalism. It enables the generation of scarcity and allows parceling materials into specific restrictions that belong to a category we have become used to calling commodity; and which can be unlocked, i.e. sold and distributed, to consumer classes of varying affluence. By developing artificial senses and at the same time restricting access to their data, resolution techniques are an instrument of power to capitalise on visibility, or, as it were, invisibility – on what we are able, i.e. offered, to see/know; and by implication on what we are not able, i.e. not offered, to see/know. Increasingly, we ‘lose sight’ of what there is we ought to see, i.e. what we ought to perceive, comprehend and make informed decisions on.

The commodification of significant and relevant meaning – something resolution practically provides us with in a technological as well as political sense – produces competitive advantage. It is therefore one of information capitalism’s main strategies for producing evaluation and appreciation schemes as well as a productive feature of profit maximisation, which is its inheritance from post-Fordist operations (e.g. while a digital camera contains the full scope of its resolution capacity the price paid determines which resolution is unlocked). It is here where the semantic field of the term resolution is corrupted, where its communicative ensemble is breached, broken up and shattered. However, resolution techniques are never pure, there are always glitches, inconsistencies, noise.

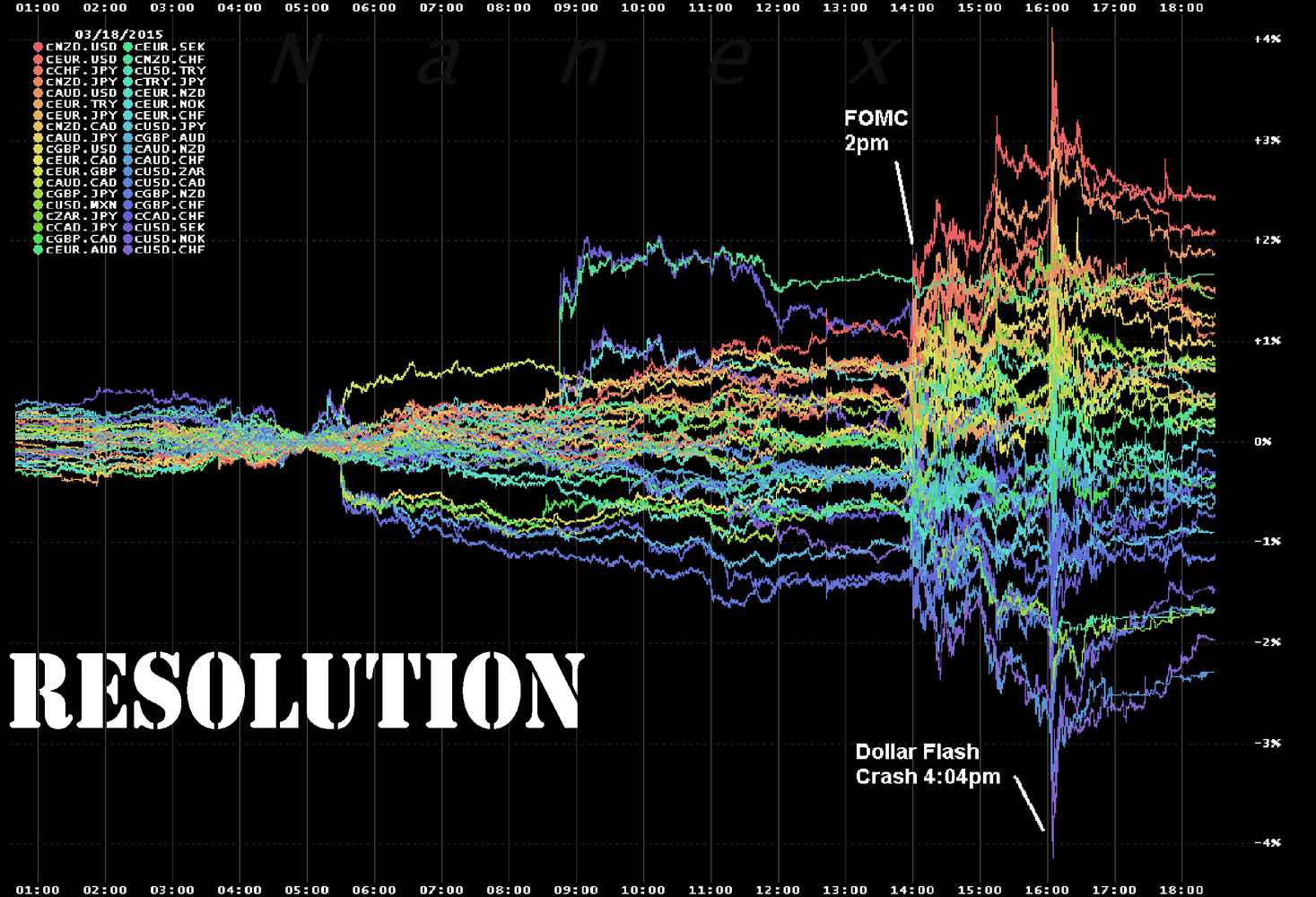

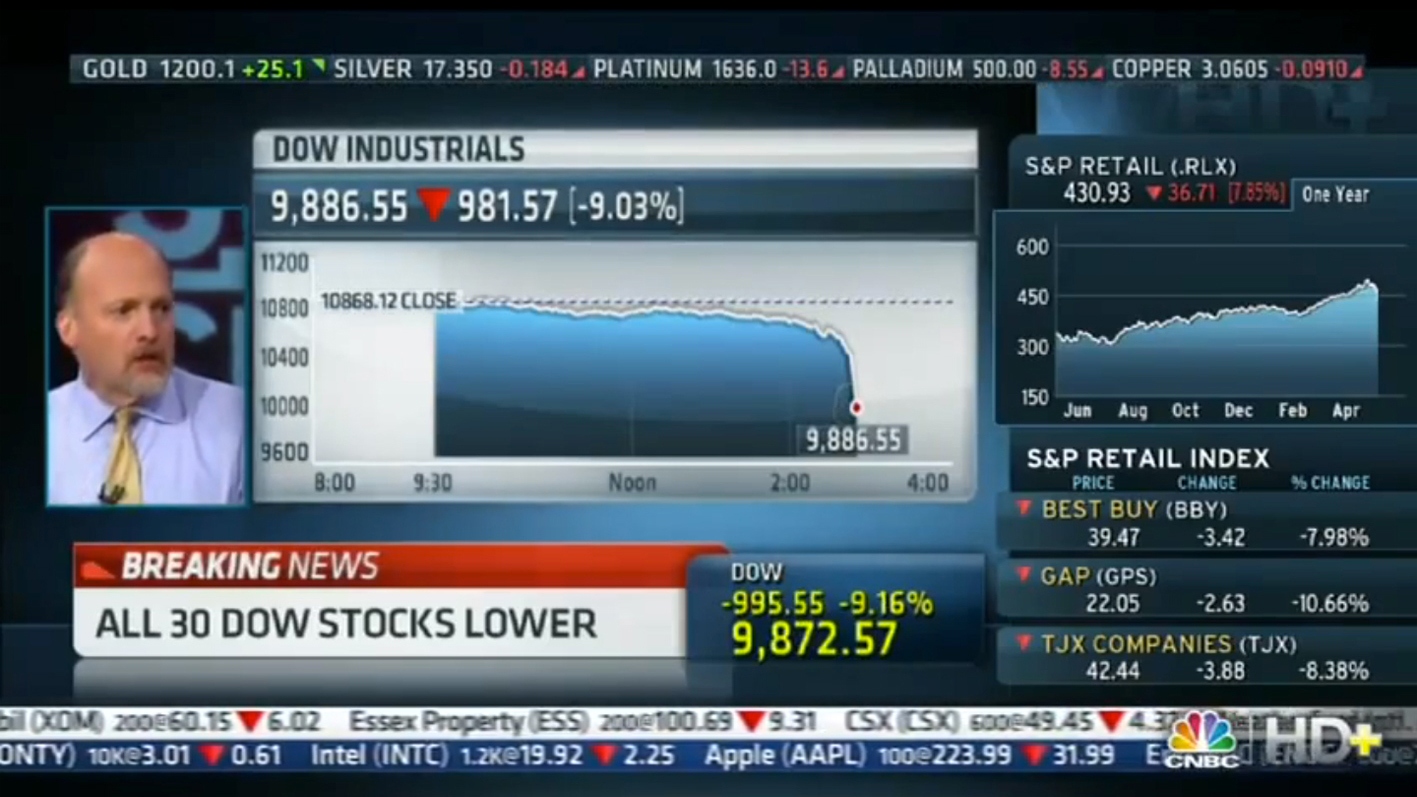

Gerald Nestler, RESOLUTIONIZATIONS. self-organized | self-regulated | mythological | resolution. Photographs of the hedge fund Sang Lucci and high-resolution visualizations of Flash Crashes (courtesy Nanex LLC), approx. 30 x 50 cm, 2015. Copyright the artist and Nanex LLC.

Gerald Nestler, RESOLUTIONIZATIONS. self-organized | self-regulated | mythological | resolution. Photographs of the hedge fund Sang Lucci and high-resolution visualizations of Flash Crashes (courtesy Nanex LLC), approx. 30 x 50 cm, 2015. Copyright the artist and Nanex LLC.

Background noise

“Noise” is the term for random information as opposed to signal in information theory. As financial markets are information markets (both in the Hayekian sense of the price regime and cybernetics), noise is a constituent element of trading. Following Fisher Black we can define it as the ubiquitous other of information (Black 1986). Noise denotes market and data inefficiencies as well as hypes that are intrinsic prerequisites for speculation in the first place. What an informed trader would therefore attempt to do is to distinguish between information and noise even though this is – according to Black – an impossible task. What, however, if noise was a multilayered efficacy of the market, a deviant protocol of gaining profit in an obscured, dark market rather than an open, light one? A move whose traces vanish easily?

The Flash Crash of May 6, 2010 was the biggest one-day decline in the history of financial markets. In less than five minutes the Dow Jones Industrial Average plunged by about 1,000 points – nine per cent of its total value – only to recover the losses almost immediately. When markets hit record lows, shockwaves went through the economic system, and CNBC-live – initially debating the Greek austerity crisis – shifted its broadcast to the trading floor of the New York Stock exchange: “what the heck is going on down here? … I don’t know… this is fear, this is capitulation.” 7

Technically, capitulation means panic-selling due to pessimism and resignation. But the live TV-coverage and subsequent investigations attested to a much deeper impact. The Flash Crash constitutes a watershed event in markets, as it gave evidence to the fact that algorithmic trading had taken center-stage and produced a hostile environment for many human traders who not only lost their bearings in the event, as a live-broadcast for professional traders illustrates: “this will blow people out in a big way like you won’t believe”. 8 Hence and apart from financial losses, capitulation means liquidation of unmediated human perception and collective resolution. Who then informs such potent noise without leaving much of a trace?

Initially, the TV-screen showed live footage of the Greek insurgence in Athens meshed with economic data feeds and real-time market prices (a constant presence not only in today’s business media) ticking away in a smaller window below. But the live broadcast of protesters pitted against police forces gradually faded, with the discussion shifting in tone and content. Market charts began to fill the screen as the conversation plunged into an emotional debate about what specific contingency might have triggered the downward flood of transactions. The suggested speculative explanations included a “fat finger event” (a typing error), a breakdown of machines (a hardware failure), a software glitch, and rapid-selling action due to the European (and especially the Greek) credit crisis. One commentator was heard reiterating recommendations to buy because of the “ridiculously low” levels of some stocks; another proposed “shock and awe” politics in order to get the economy running again. The forceful global deformations introduced by the neoliberal reformulation of self-interested profit maximisation became apparent in this instant of simultaneous broadcasting of civil unrest and financial war. The live coverage of the uprising in Greece and the fall in prices, each with its accompanying visual and oral rhetoric, unintentionally evoked the stark contrast between the capitalist regime of financialization on the one hand, with its debt-induced grip on politics and the economy, and on the other hand the effects of this regime on the notion of the public good. When the spotlight panned from the destroyed common ground in Greece to the historic instance of an algorithmic crash, market disequilibrium on a gigantic scale obscured a catastrophic failure of an even vaster extent. The Flash Crash eclipsed what has become the symbol of the ruination of the agora of commonality, epitomized by the eruption of popular protest in the site of its ancient origin in Athens.

Below the radar of agencies that were established to monitor market activity, corporate self-interest had created an even deeper level of incorporation: it was programed into the “genetic” code of a new breed of financial agency, the automated daemons 9 of algorithmic trading. Derivatives of mathematical models, algorithms had already revolutionized the logistic infrastructure of exchanges by displacing the trading pit and thus its market makers (the human traders known as “locals”) in favor of faster execution rates. Subsequently, these daemonic powers were let loose to directly negotiate with one another on computerized matching machines, exploiting trading opportunities at a speed inaccessible to their human competitors. The foundations for this radical shift were established in the early 1970s. Donald Mackenzie informs us that “financial economics […] did more than analyze markets; it altered them. It was an ‘engine’ in a sense not intended by [Milton] Friedman: an active force transforming its environment, not a camera passively recording it” (MacKenzie 2006) Gil Scott-Heron’s 1970 “The Revolution Will Not be Televised” comes to mind, a politically radical poem released at about the same time when the most significant model, the Black-Scholes formula, introduced an algorithm that sparked the first derivative wave of neoliberal market revolutions that today hold sway over the world. But while Mackenzie’s account is mainly concerned with “bodies” and their operations, High Frequency Trading (HFT) has in the meantime abandoned human traders and their site-specific resolution apparatuses for quant-coded algorithmic high-res market making.

As collateral damage, the epitome of territorialised capitalism, Wall Street, had become a mere symbol. While the crowded trading floor of the New York Stock Exchange (NYSE) is still the undisputed televisual icon of the “market,” the media presence obfuscates, more than reveals, what the market has actually become, as a result of what I term the quantitative turn in finance. Since 2012 the NYSE and its trading floor have been the property of Intercontinental Exchange, a provider of algorithmic trading platforms operating from Atlanta, USA (David 2012). The new pivotal architectural nodes of what has turned into a deterritorialized, informational capitalism are now the nondescript and non-representative warehouse buildings, filled to the brim with computer servers and fiber optics, in suburban areas such as Mahwah, New Jersey 10. Although in 2010 this was still future in the making, something unsettling had dawned on acute observers of the epic failure described as the Flash Crash: algorithmic daemonic powers had slipped away from human control. For the first time, bots had caused mayhem. Not only were automated trading desks affected, but this “revolution” flashed into view as a globally televised event.

The subsequent investigation resulted in a joint official report by the United States regulatory authorities, the SEC and the CFTC. It was published a few months after the incident and put the blame on human trading. In contrast, an analysis of the event conducted by a small financial data provider claimed that the crash was in fact caused by orders executed automatically by algorithms. Nanex LLC, a financial service provider, records trading data and was therefore in the position to examine the event on their own account. They soon realised that conventional market data records did not show any material traces of what might have initiated the rupture that tore the intricate fabric of market prices. Therefore, they decided to go deeper and look at shorter time-intervals. Step-by-step, they enhanced the resolution and developed custom-made bots to analyse the Flash Crash at dizzying depths of time. Finally, they noticed material evidence of market activity at fractions of a second. As the founder and CEO of Nanex, Eric Hunsader, stated:

The SEC/CFTC analysts clearly didn’t have the dataset to do it in the first place. One-minute snapshot data, you can’t tell what happened inside of that minute. We didn’t really see the relationship between the trades and the quote rates until we went under a second. 11

At first glance, it looked like a glitch. But what emerged were the material traces of an elaborate scheme. But although Nanex found evidence of activity, the actuator(s) of this spasmic reaction could not be exposed. In order to support their claim, Nanex had to win access to proprietary and therefore secret trading records to match the data and verify the facts. This unlikely situation arose when Waddell & Reed – the mutual fund that was blamed for the crash – decided (passed the resolution, as it were) to share their trading data for comparison – a remarkable decision, as such an act contravenes the implicit rules of the financial industry. It could shake shareholder confidence – the holy grail of neoliberalism – and jeopardise reputation if done publicly. As a consequence, and in contrast to the official report, the forensic analysis exposed that the official culprit could not be held accountable. In their final statement Nanex concluded: “High Frequency Trading caused the Flash Crash. Of this, we are sure.”

The figure of the renegade

The findings concerning the Flash Crash result in specific consequences of which some are associated with the analysis while others are part of the artistic research 12. The former include the fact that even though material traces of previously invisible quotes and trades were uncovered and provided evidence they did not open access to knowledge. Only the full disclosure and investigation of secret proprietary data records would allow attribution. Up to this day, the actual catalysts of the Flash Crash are unknown.

The financial market architecture with its proprietary algorithmic logistics has become a black box, both with regard to the parameters of official inquests and, much more generally, in terms of knowability. Thus, what the black box emits is not information but noise. This technowledge exerts influence not only on much of the industry, but eventually cripples the public forum as a whole. We encounter a global system that acts not only in the dark but “in the dark of time.”

The artistic research, in turn, exposed a further consequence: In the current legal and technological frameworks, which privilege financial autonomy by property rights and self-regulation (a premise not only of the law but also of cybernetics), an effective analysis of market events depends on insider knowledge. It is contingent on a “double figure of the expert witness”, that is, when an informant joins the investigation. Only crisis – a scandal, a counter-provocation – can disrupt affiliations and break the veil of secrecy. By providing material from undisclosed or classified sources on a broad range of subjects this figure has in recent years turned the principal witness for the public, procuring otherwise unavailable evidence of violence. In the financial context, this particular manifestation of the witness — who does not testify on the basis of real presence — becomes the medium of forensics by a logistics of redirection (e.g. the leaking of confidential material that cannot — must not — speak for itself). This witness is not a plain informant. The financial renegade who presents objects as subjects-of-debate is an expert witness as much as the scientific analyst ally who subsequently (re)constructs the forensic narrative by composing the facts.

This Janus-faced configuration of the renegade 13 as a doubled expert witness might indeed be a figure that resonates with the complex situations encountered by forensics, in which “only the criminal can solve the crime.” 14 The notion of the expert witness as one who is involved in event(s) seems to highlight the Achilles’ heel of the particular mode of calculative oppression that works through the financial paradigm of the neoliberal market. The intricate problem of the resolution of the Flash Crash demonstrates the ambiguity contained: the participation of an insider or even (alleged) perpetrator is required in order to unearth evidential data that is buried (in undisclosed documents, in fractions of a second or other fields of technowledge).

Poetics of Resolution

The story of the Flash Crash offers an example of paradigmatic and at the same time ambiguous significance for the possible production of future forums. It depicts in all its complexity the horizon of an exposed and discontinuous self-regulating force against the boundless utopia of a self-regulating market. What this exposes is an ambivalent, contingent and marginal figure whom I propose to call the “renegade”. Merriam Webster defines “renegade” as (a) a “person who leaves one group, religion, etc., and joins another that opposes it” and (b) as “someone or something that causes trouble and cannot be controlled.” The renegade transgresses the unwritten laws of complicity and secrecy. The renegade is a traitor and defector for a system or an industry who often by default rather than design becomes an educator for the general public (in institutional degrees) – a fact that obviously exceeds finance and takes effect in other power fields as well.

Her marginal position notwithstanding, however, she points to a destination that emphasises the need to look for resistance inside rather than outside of capitalism. In fact, the renegade constitutes an act that proceeds from mere dissent (critique within a system) to concrete insurrection (an act of resistance and renunciation). A whistleblower, for instance, is an expert acting from a point of no return, a risk taker at the point of ultimate crisis who rises up against wrong. By speaking out and sharing proprietary data, business strategies or classified information, she not only discloses what was excluded from public debate but also manifests noncompliance as an act of civil courage for the greater good. This is a point to be taken seriously even when the experiences that cause her to be disobedient do not inform an ethical decision to act against violence but to an attempt to improve and advance the system – a fact that applies to many industry whistleblowers. The renegade is not a heroic figure; it is as ambiguous as the world she inhabits. This is not to a disadvantage of the concept but the contrary: in the midst of (fabricated) noise, the system yields information (accidentally). The renegade act – essentially a violation of current custom, rule or law – produces a host of viable resolution materials across the semantic field of the term ranging from shared visualisation, discrimination and cognition to decision-making. Whatever the impulse, each act perforates an autonomy that is decreasingly conceded to natural persons but granted to (consolidated) corporate bodies by virtue of their assumed maturity and complexity.

At the same time, the renegade act is an act that reclaims autonomy against all odds. That said, it certainly does not constitute political autonomy with capital A – an autonomy that bestows rights or vests powers. To the contrary, it often constitutes a singular act that attracts serious problems and is prone to fail.

On the level of an artistic approach focusing on an aesthetics in the field of consequences and a poetics of resolution, however, it can serve as a model to understand forms of resistance that are intrinsic to art and to society at large. Artistic practice turns into a transition movement that does not uphold autonomy for itself in contrast to other fields of labor but instead delves into those cracks and openings produced by the axiomatic system in which what appears as noise turns out to be actual information. Here, new narratives wait to be taken up and contextualised. The logics of such a work is distinctly artistic from the beginning, from the first approach to resolution as an act that discovers imagery and imagination. It is materialist and at the same time speculative. It is collective as it deals with assemblages that it is part of.

The renegade, if embodied by a single person, is an extremely precarious position, as recent history has unmistakably shown. Moreover, the growing enclosure and commodification of data lead to the algorithmic constitution of virtual subjects that are increasingly separated from their individual bodies. What looms on the horizon is the latter’s disappearance from negotiations on status, rights, and autonomy.

However, if we open and expand the figure of/DERIV the renegade to a collective notion – from a single person to a collective of expert practices and voices – we could create renegade corporations as a forceful strategy to counter information capitalism and its grip on life. And thus develop “assemblies” in which a collective of experts – activists, artists, scientists, etc – work together on enhancing resolution across the whole gamut of its meaning. The autonomy gained might seem marginal, in a state of constant flux, and even volatile if not dangerous. At the same time, it could produce myriad forms knowledge and generate activist tactics of infiltration. At best, it would not only call but win people to renounce allegiance by offering assemblies and institutions of what could be termed “renegade solidarity”. It is more a case of offering platforms of affiliation rather than conformity and of strengthening the desire to participate.

The term “resolution” comprises a rich semantic field that reaches from how we perceive to what we can know, to what we can do and how we decide within the concept of poetic acts. Technically, resolution speaks of intellectual as well as affective potentials and involves technological and algorithmic operations. It can thus be seen as a paradigmatic node of how we may sense, develop, differentiate and support relations between humans and non-humans. Moreover, it holds the potential for thinking and creating access to value in contrast to the capitalist price(ing) engine without losing the performative edge necessary within complex societies in flux. Against the enclosures of capital (a “derivative autonomy” which has also captured and finkncialised the arts), autonomy might have to be reconceptualised as a dynamic, open, sometimes aleatoric and instantaneous process (acts connected to a multitude of contingent moments) that purposely integrates ambiguous, heteronomous influences in order to make resolution in the full meaning of the term.

As an artistic notion, the presented concepts transgress contemporary art as we know it. As an artistic practice, their orientation is aesthetic in the sense of perceiving and applying leverage points for a poetics that moves beyond the typical capitalist framework. Contrary to market activity (which includes the art “market”) artists rarely indulge in insuring, speculating on or dealing with risk. Rather, artists embody risk (the term “wording” might be useful here). Their “derivative mode” of production is not about securing a future-at-present by recalibrating (pricing) every conceivable expectation. Rather, they affirm and employ risk as the potential to trust and thus imagine (materially speculate on) how to realise a common expectation: building worlds in which the depth of resolution does not collapse into a surface for a few. Which is to say that art is political resistance by default.

- Nestler, Gerald, ed. 2007. “Derivative Narratives.” In Yx - Fluid Taxonomies, Enlitened Elevation, Voided Dimensions, Human Derivatives, Vibrations in Hyperreal Econociety. Schlebrügge.Editor.

- Adler, Jerry. 2012. “Wired Business.” http://www.wired.com/2012/08/ff_wallstreet_trading/.

- Black, Fischer. 1986. “Noise.” The Journal of Finance 41 (3): 529–43.

- David, Javier E. 2012. “ICE to Buy NYSE for $8.2 Billion, Ending Era of Independence.” http://www.cnbc.com/id/100330589.

- Eckermann, Sylvia, and Gerald Nestler. 2009. “The Trend Is Your Friend!” http://syl-eckermann.net/TIYF/index.html.

- Farmer, James Doyne. 2013. “The Impact of Computer Based Trading on Systemic Risk.” http://www.lse.ac.uk/fmg/events/conferences/Systemic-Risk-Centre/Foresight-Report_110113/Papers-and-slides/Doyne-Farmer.pdf.

- Freud, Sigmund. 1927. The Ego and the Id. L. & Virginia Woolf at the Hogarth press, and the Institute of psycho-analysis.

- MacKenzie, Donald A. 2006. An Engine, Not a Camera : How Financial Models Shape Markets. MIT Press.

- Nestler, Gerald. 2014. “Mayhem in Mahwah The Case of the Flash Crash; or, Forensic Reperformance In Deep Time.” In Forensis: The Architecture of Public Truth, edited by Forensic Architecture. Sternberg Press and Forensic Architecture.

- ———. 2015. “The Renegade; An Aesthetics of Resolution. Some Thoughts on a Techno-Imaginative Toolbox and Its Potential for Art as and beyond Critique.” In ISEA 2015. ISEA. http://isea2015.org/proceeding/submissions/ISEA2015_submission_219.pdf.

- ———. 2010. “A Scopic Mode of World Production. Derivative Money, Technological Capitalism and a Recourse on Artistic Research.” In Kunst Fördert Wirtschaft. Zur Innovationskraft Des Künstlerischen Denkens, edited by Ursula Bertram. transcript. http://www.geraldnestler.net/Texts/2010_Scopic-Mode-World-Production.pdf.

- ———. 2012. “Skewed Entrails: The Non-Space of Money or the Pseudo-Common Oracle of Risk Production.” In Paratactic Commons. amber12 Art and Technology Festival Catalog. BIS/Body-Process Arts Association. http://issuu.com/ekmelertan/docs/amber12.

- Weizman, Eyal. 2011. The Least of All Possible Evils : Humanitarian Violence from Arendt to Gaza. Verso.

-

The research project resulted in the text Mayhem in Mahwah: The Case of the Flash Crash; or, Forensic Re-performance in Deep Time (Nestler 2014) and the video Countering Capitulation. From Automated Participation to Renegade Solidarity, High-frequency trading and the forensic analysis of the Flash Crash, May 6, 2010. 2013-2014. Single channel video (11:25 min.). See: https://vimeo.com/channels/aor ↩

-

A further example on finance as a field of artistic practice, The Trend Is Your Friend! (Eckermann and Nestler 2009) A text that focuses on this topic is A Scopic Mode of World Production. Derivative money, technological capitalism and a recourse on artistic research (Nestler 2010). ↩

-

I first described the derivative condition in the text Derivative narratives (Nestler 2007). ↩

-

James Doyne Farmer, co-director of the program on complexity economics at Oxford’s Institute for New Economic Thinking, notes that “under price-time priority auction there is a huge advantage to speed”. See (Farmer 2013). ↩

-

Contrary to declarations by high-frequency trading outfits that HFT provides liquidity to the entire marketplace, Automated Trading Desk LLC (who pioneered automated HFT in the wake of the 1987 market crash) state on their webpage: “Welcome to the future of automated trading. […] A world where only those that can move fast enough to predict market shifts are able to compete at the highest level.” http://www.atdesk.com, last accessed November 2015. ↩

-

See also Skewed Entrails. The Non-Space of Money or the Pseudo-Common Oracle of Risk Production (Nestler 2012). ↩

-

See http://youtu.be/IJae0zw0iyU. ↩

-

To qualify, human traders ultimately (a matter of minutes) had to enter the site of devastation and rescue the market and the market place. Algorithmic trades had triggered and intensified selling but did not revert to buying. ↩

-

The website of the Linux-based operating system Arch has a short and comprehensive definition: “A daemon is a program that runs as a ‘background’ process (without a terminal or user interface), commonly waiting for events to occur and offering services. A good example is a web server that waits for a request to deliver a page […]. While these are full featured applications, there are daemons whose work is not that visible.” ↩

-

“The data centre of NYSE Euronext, the international conglomerate that includes the New York Stock Exchange, is in a building in suburban Mahwah, New Jersey, 27 miles from Wall Street.” (Adler 2012). ↩

-

See http://www.sify.com/finance/u-s-flash-crash-report-ignores-research-nanex-news-insurance-kkfiEjeciij.html. ↩

-

Due to the limitation of space, this research is not further described here. Please see footnote 1 for reference and links. ↩

-

The notion of the renegade was developed further in a talk at A Few Reasons For A Non Dismissive Art (missing reference) and in The Renegade; An Aesthetics of Resolution. Some Thoughts on a Techno-Imaginative Toolbox and its Potential for Art as — and beyond — Critique (Nestler 2015). ↩

-

This is the subtitle of the chapter on Forensic Architecture in The Least of All Possible Evils: Humanitarian Violence from Arendt to Gaza (Weizman 2011). ↩